Strengthening the regional roots while branching out

Home is where the heart is, but how can UK businesses expand their presence to fresh UK regions without losing focus?

Featured Regions:

Northern Ireland, East of England, South England

Branch out to new markets

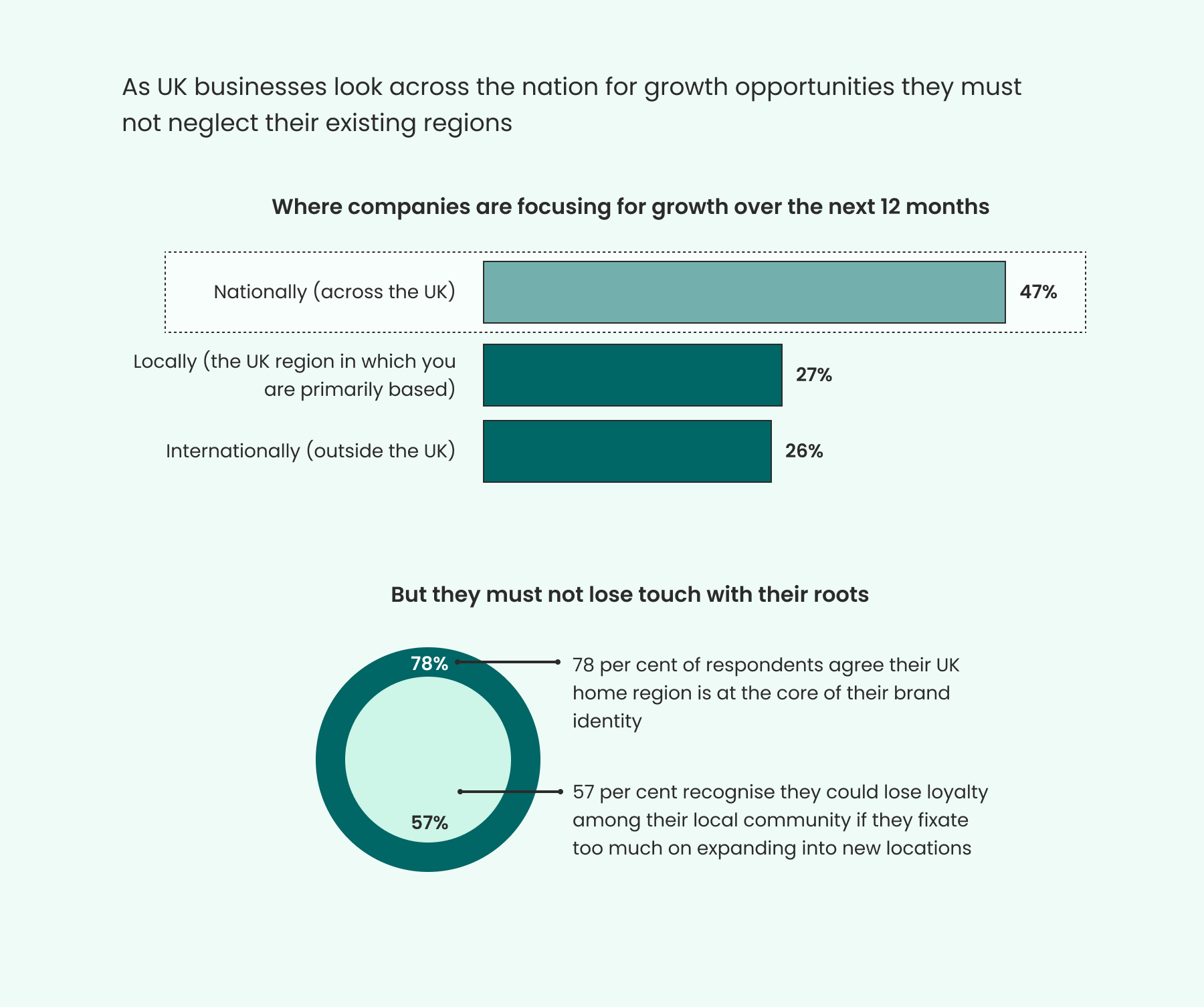

New research by Barclays Corporate Banking shows that a relative majority (47 per cent) of surveyed UK businesses plan to branch out across the UK in pursuit of growth over the next 12 months. Extending a business’s geographical reach can be a great way to reach new customers – but businesses must ensure these expansion efforts do not diminish the customer experience they deliver in existing markets.

For many businesses, the answer lies in a balance between the two priorities. Rather than targeting international markets or deepening presence in UK regions where they are primarily based, 47 per cent of those surveyed plan to expand their presence across the UK to drive growth and reach new customers over the next 12 months. Of those, 50 per cent plan to strike a balance between existing and new regions. That compares with 26 per cent who prefer to maximise revenue in existing areas of focus, and 24 per cent who will prioritise new locations.

For many, income from home regions is a significant life source

It would be unwise to neglect thriving sources of business in order to explore new territories. After all, 41 per cent of the companies surveyed say that their region of origin is their main source of revenue. For many companies their home region is more than just a source of revenue: it’s part of who they are. Overall, 78 per cent of respondents agree their UK home region is at the core of their brand identity – rising to 86 per cent among businesses in the East and South of England, and the Midlands. Companies are aware of the significance of this connection. Indeed, 57 per cent recognise they could lose loyalty among their local community if they fixate on expanding into new locations.

A balanced approach means continuing to deliver quality products and services to current markets, while beginning to look for new customers further afield. That involves maintaining resource in existing regions, including staffing levels. For example, leaders should consider how to maintain service levels when experienced personnel are redeployed to work on expansion-related projects – perhaps by upskilling colleagues to take on increased responsibilities.

Decoding the dynamics of unfamiliar territories

On the other side of the equation, businesses must prepare rigorously to meet the requirements of new markets. Supply chain development is ranked in the research as the top strategic consideration for accessing new customer markets over the next 12 months. Businesses also recognise the need for a strong financial position for expansion, with other top considerations including financial partnerships and maximising working capital. Maintaining a healthy level of working capital – that is, the difference between current assets and liabilities attached to everyday operations – is vital to ensure businesses have the financial flexibility to fund their ambitions.

This is crucial, because as they expand, businesses may need to refine existing operating models in response to certain market dynamics. For example, respondents from Northern Ireland stand out in the research for their focus on reducing carbon emissions. Thirty-two per cent say that minimising carbon emissions is key to moving into new markets. That’s double the level for the UK consensus in the research (15 per cent), indicating that it is a top consideration for Northern Irish businesses, above factors such as access to funding, inflation or trade barriers.

“From speaking to clients in Northern Ireland, there are SMEs and family-owned businesses here that are still in the early stages of their ESG [environmental, social and governance] journeys, but they’re encountering external market pressures that mean sustainability is rapidly moving up the agenda,” says Adrian Doran, head of Northern Ireland, Barclays Corporate Banking. “We’ve heard how clients in the agri-food sector are focusing on their environmental footprint, whereas manufacturing clients are experiencing pressure from large corporations at the top of the value chain as they seek emissions cuts from suppliers.”

Giant's Causeway, Northern Ireland, United Kingdom

Adobe Stock

From speaking to clients in Northern Ireland, there are SMEs and family-owned businesses here that are still in the early stages of their ESG [environmental, social and governance] journeys, but they’re encountering external market pressures that mean sustainability is rapidly moving up the agenda

Adrian Doran, Head of Northern Ireland at Barclays Corporate Banking

The rewards of achieving balance

The data suggests that being responsive to requirements while pursuing a balanced regional strategy has its rewards: 38 per cent of Northern Irish respondents report their business has benefited from optimised carbon emission levels by improving the level of attention given to different geographic regions of interest.

Food-to-go manufacturer Around Noon is an example of a business that has struck a delicate balance of achieving growth in new territories whilst maintaining a premium offering to its existing client base. “Since being established in 1989 on a family kitchen table in Newry – Northern Ireland, Around Noon has grown sales both at home and in England, which includes a London based acquisition in 2017 and further expansion this year with our purchase of London-based Soho Sandwich Company,” says CEO, Gareth Chambers. He adds: “Our sales growth, both in Ireland and Great Britain, is expected to see the business almost double turnover this year to £80m, and we have aspirations for further geographical expansion, targeting revenue of £100m.”

Throughout this growth phase, Around Noon has focused on reducing its carbon footprint, introducing solar panels, an electric vehicle delivery fleet and a plastic reduction program over time, which it estimates will see savings of approximately 60 tonnes per annum. “There are growing market opportunities for businesses who can demonstrate progress on their transition journey,” enthuses Barclays Corporate Banking’s Doran.

As businesses seek to increase revenue and reach the next phase of growth, a wider UK presence is often the natural step to build a bigger customer base. For many, the trick is striking the right balance between focusing on winning new customers and keeping existing ones happy.

Carrick-a-Rede Rope Bridge in Ballintoy in County Antrim, Northern Ireland, United Kingdom

GETTY IMAGES

The information contained and views expressed in this article are intended purely for information and interest purposes only and no warranty or undertaking regarding the accuracy or completeness of the information of views is given. They should not be used to make any decisions or take any actions.