It takes two: how partnerships fuel regional expansion

UK businesses are finding that partnerships are the key to achieving regional expansion

Featured Regions:

East of England, Northern Ireland, Wales

Partnerships fuel expansion

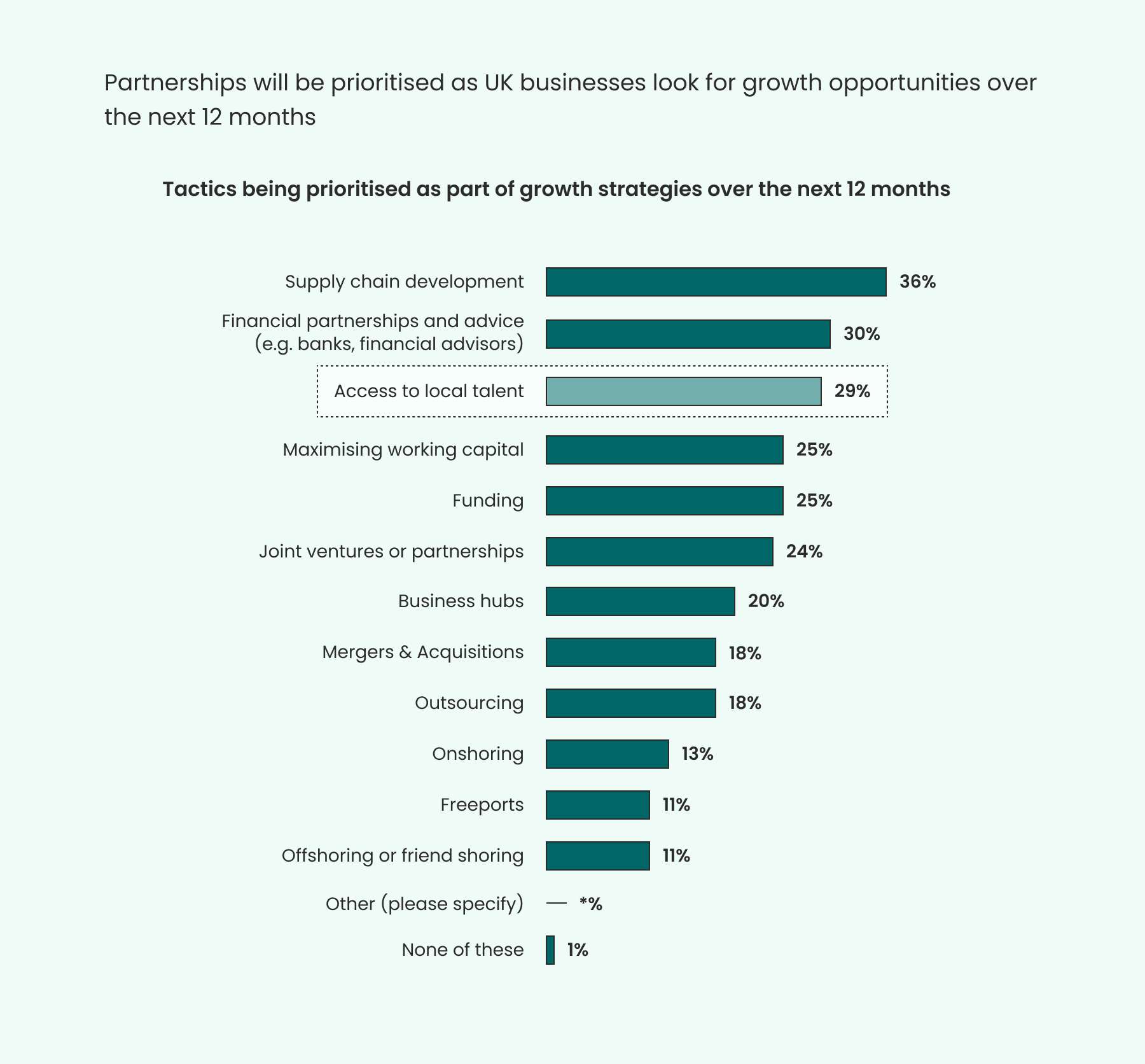

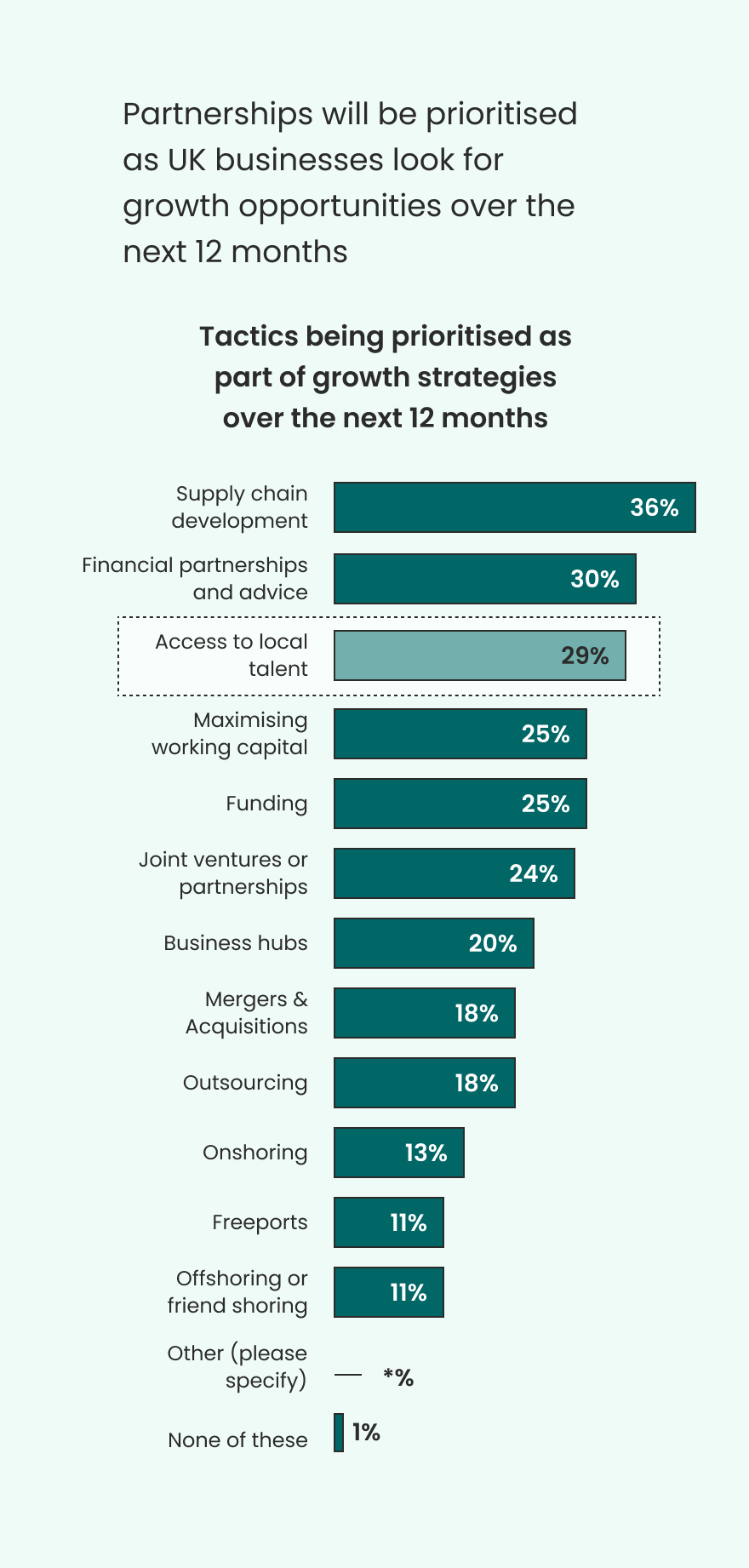

To access new opportunities in today’s uncertain economic climate, nearly 70 per cent of UK businesses surveyed are considering expanding their reach into new territories, according to new research by Barclays Corporate Banking.

And rather than taking these strategic decisions alone, business leaders are investing in external partnerships for guidance on which locations to prioritise and how to fund their regional ambitions. Nearly nine out of 10 of business leaders lean on external support when deciding which regions to focus on.

Partners are guiding businesses in new regions

As companies battle to enter new customer markets in a climate where rising energy costs and inflation are placing pressure on budgets, many businesses consider support from external partners essential when deciding how much to invest in their existing regions and whether they should be bold and branch out to new territories. Popular sources of external support that business leaders draw on are consultants, financial firms and data analytics firms.

The research shows that most of the UK businesses surveyed expect their new regions of focus to be within the UK. Just 26 per cent of the business leaders say they are looking internationally for growth opportunities, and 65 per cent of this group are focusing on Europe.

County Antrim, Ballintoy, Carrick-a-Rede Rope Bridge, in Northern Ireland, United Kingdom

GETTY IMAGES

How to lighten the financial load

Once a growth territory has been identified, the next challenge a business will face is how to finance the expansion. As part of their mission to expand into new customer markets within and outside the UK over the next 12 months, a significant portion of the businesses surveyed plan to rely on financial partnerships, such as banks, accountants, and financial advisers, as well as needing to raise finance.

Financial partnerships are especially important to Northern Irish businesses. Companies in this region are most likely to say that access to funding is impacting their ability to maximise growth opportunities. A significant portion of Northern Irish respondents (27 per cent) operate within the hospitality industry: this heightened focus on financial partnerships could be triggered by the recent funding cuts from the region’s tourism board.1 Many Northern Irish businesses see external expertise as a solution, with 41 per cent saying that financial partnerships will be most important when focusing on funding opportunities and accessing new customer markets over the next 12 months, compared to just 30 per cent of businesses overall.

Having the funds to invest in growth opportunities, such as expanding into new territories, is vital for the long-term competitiveness and survival of businesses. To save regional innovation hopes from being flattened by a tightly bound cash flow, companies should work with their partners to focus on the most efficient ways to raise finance, which may be via releasing working capital. For example, the research shows that 60 per cent of business leaders found invoice financing to be the easiest way to maximise working capital over the past 12 months. With this track record in mind, it may be wise for UK businesses to prioritise this method moving forward.

Compared to other regions in Barclays’ research, companies in the east of England appear to have found it easier to maximise their working capital through a range of routes over the last 12 months. These routes include: sourcing support from private equity firms, business loans — such as asset based lending, invoice financing and managing currency risk.

“Companies in the east of England have shown resilience in finding ways to unlock working capital,” says Stephen Ainsworth, head of mid-corporate east at Barclays Corporate Banking. “But these businesses need to make sure they continue to generate sufficient cash flow to navigate economic uncertainty, to remain agile and support growth. This can be achieved through the help of a reliable partner.”

Companies in the east of England have shown resilience in finding ways to unlock working capital

Stephen Ainsworth, Head of Mid Corporate East at Barclays Corporate Banking

Finding the right partner

Research shows that poor professional advice from third parties has resulted in £6.4 billion of losses for UK enterprises.2 Businesses will need to choose their partners carefully so they can trust their recommendations about which regions to prioritise, especially those in Northern Ireland who plan to rely strongly on support from financial partnerships over the next 12 months. That means looking at previous work to see whether prospective partners have credible experience in the industries and regions of focus, asking for recommendations and seeking out impartial reviews.3

“Consistent relationships with reliable partners have been instrumental in the growth of our business,” says Mitesh Dhanak, founder of Precious Homes. “It's important that partners have credible knowledge of our industry and clearly understand what we are trying to achieve, so their teams can provide the best solutions for us. Regular face-to-face meetings are crucial to problem solving and achieving better outcomes.”

Driftwood on the Norfolk coastline, United Kingdom

Adobe Stock

To finance and execute regional strategies effectively, UK businesses are consulting outside expertise to make sure they invest in the right locations. But success will depend on their ability to identify and select credible partners that fully understand their business needs. This due diligence will ensure that partner recommendations can be fully trusted to inform business decisions.

The information contained and views expressed in this article are intended purely for information and interest purposes only and no warranty or undertaking regarding the accuracy or completeness of the information of views is given. They should not be used to make any decisions or take any actions.